Detailed Guidelines for Finishing Your Online Tax Return in Australia Without Mistakes

Detailed Guidelines for Finishing Your Online Tax Return in Australia Without Mistakes

Blog Article

Step-by-Step Overview to Finishing Your Online Tax Return in Australia

Browsing the online tax return procedure in Australia calls for an organized strategy to make certain compliance and optimize possible refunds. It's vital to recognize the complexities of the tax obligation system and gather all relevant documentation, consisting of income declarations and reduction receipts.

Understand the Tax System

In Australia, the tax obligation year runs from July 1 to June 30, and individuals usually lodge their returns between July 1 and October 31. The Australian Tax Workplace (ATO) is the controling body accountable for tax obligation administration, guaranteeing conformity and supplying guidance to taxpayers. Tax obligation prices are modern, meaning that higher income earners pay a better percent of their earnings in tax obligations.

Furthermore, it is essential to be aware of vital days and adjustments to tax obligation legislation that may influence your return. By grasping the basics of the tax system, you can make educated decisions when completing your online tax obligation return.

Gather Required Papers

Having a strong understanding of the tax obligation system prepares for an effective on-line tax return procedure. Among the necessary action in this journey is gathering the required documents. This makes certain that you have accurate info to complete your income tax return effectively.

Begin by collecting your revenue declarations, such as your PAYG summary from your company, which information your revenues and tax obligation withheld. If you are self-employed, prepare your earnings and loss declarations. In addition, collect any type of financial institution declarations mirroring interest earnings and dividend statements from your investments.

Next, compile your reductions. online tax return in Australia. This might include receipts for occupational expenditures, charitable contributions, and clinical expenses. If you have a residential or commercial property, guarantee you have documents of rental income and associated expenditures, including repair services and maintenance costs

Also, don't neglect to include any other appropriate papers, such as your Medicare card, which could be essential for sure cases. Completing this step carefully will not just conserve time however also assist in optimizing your potential reimbursement or decreasing your tax obligation responsibility. With all files in hand, you will certainly be well-prepared to continue to the next stage of your online income tax return procedure.

Choose an Online System

Choosing the best online platform is an essential action in the income tax return process, as it can dramatically impact your experience and the precision of your entry. With numerous options readily available, it's necessary to take into consideration several aspects to guarantee you select a system that fulfills your requirements.

First, examine the system's online reputation and customer reviews. Try to find solutions that are well-established and have positive feedback regarding their dependability and ease of usage. In addition, make certain that the platform is signed up with the Australian Taxation Workplace (ATO), as this assurances conformity with legal requirements.

Following, take into consideration the functions supplied by the system. Some systems give easy-to-follow directions, while others may supply innovative tools for even more complex tax obligation circumstances. Choose for a platform that go to the website provides specifically to your monetary circumstance. online tax return in Australia. if you have several earnings resources or deductions.

Last but not least, examine the prices related to each system. While some offer complimentary solutions, others might bill fees based on the complexity of your return. Weigh the expenses versus the functions offered to make an enlightened choice that matches your spending plan and needs.

Complete Your Income Tax Return

Finishing your income tax return is an important step that needs cautious interest to detail to make sure exact reporting and compliance with Australian tax legislations. Begin by gathering all required documentation, including your income declarations, receipts for reductions, and any various other pertinent economic documents. This fundamental step is crucial for a exact and comprehensive tax obligation return.

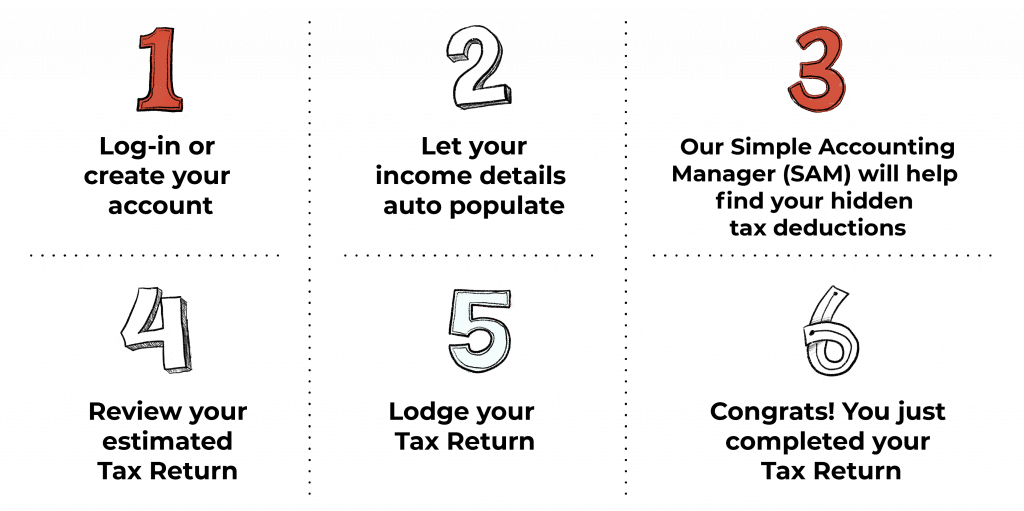

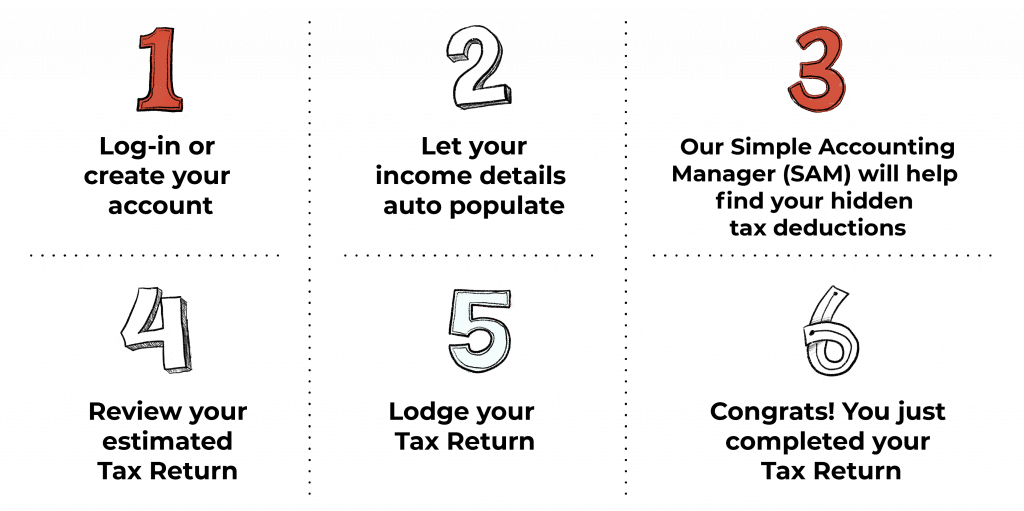

Following, log into your picked online platform and browse to the tax return area. Input your personal info, including your Tax File Number (TFN), and confirm your residency status. When entering revenue information, make certain that you classify it properly, such as income, incomes, or investments.

For reductions, be thorough in providing all eligible costs, such as work-related prices, contributions, and medical costs. The on the internet system typically supplies prompts and tips to aid you in recognizing potential reductions.

Furthermore, put in the time to assess any pre-filled information offered by the ATO, as this might include details from your employer or economic establishments. Accuracy in this stage is important, as mistakes can cause delays or charges. After thoroughly entering your info, you are currently gotten ready for the following step: assessing and finalizing your return.

Review and Submit Your Return

The evaluation and submission phase of your tax obligation return is vital for ensuring that your financial details is certified and exact with Australian tax guidelines. Before completing your return, make the effort to completely evaluate all access. Confirm your revenue sources, deductions, and any type of offsets you are claiming to guarantee they line up with the paperwork you have actually collected.

It is suggested to compare your reported figures against your income statements, such as the PAYG summaries from companies or financial institution passion declarations. Pay certain interest to any type of inconsistencies, as even minor errors can bring about significant issues with the Australian Taxes Workplace (ATO) See to it all numbers are gone into properly, as incorrect or left out information can postpone handling or cause fines.

Final Thought

Completing an on-line income tax return in Australia demands an organized technique to guarantee precision and compliance. By understanding the tax obligation system, gathering called for documents, selecting a reputable online platform, and thoroughly completing the income tax return, individuals can browse the process successfully. A detailed evaluation and timely entry are essential actions that contribute to an effective declaring. Keeping copies of the submitted return and ATO verification offers essential paperwork for future referral and potential queries.

To efficiently browse the online tax return process in Australia, it is critical to first understand the underlying tax system. By comprehending the principles of the tax obligation system, you can make enlightened decisions when completing your on the internet tax obligation return.

Having a strong understanding of the tax obligation system lays the foundation for a successful online tax return process.Completing your tax return is a crucial action that calls for mindful focus to information to ensure accurate reporting and compliance with Australian tax obligation legislations. By recognizing the tax obligation system, celebration called for papers, picking a trusted online system, and diligently completing the tax obligation return, people can browse the procedure read here properly.

Report this page